do you pay property taxes on a leased car

Some states charge ad valorem taxes based on the value of the property you own. Excess Mileage Fees.

Leasing A Car Consumer Business

In California the sales tax is 825 percent.

. Do you have to pay property taxes on a leased car if you dont own the car. Even if the vehicle is not. The tax is levied as a flat-rate percentage of the value and.

The lease payment and. Almost every contract has a strict cap on how many miles you can drive during the course of the lease agreement. Exceed that mileage limit and youll.

This means you only pay tax on the part of the car you lease not the entire value of the car. The local car tax is 1812 if the price is 18200 x 70. When you lease a car in most states you do not pay sales tax on the price or value of the car.

The most common method is to tax monthly lease payments at the local sales tax rate. You pay an annual tax on the car on the NADA value so a car with an inflated motorhome is ideal. Yes you still have to pay property taxes on a leased car even though you dont own the car.

Deducting sales tax on a car lease. As a result the lease agreement would most likely require the tax to be paid by the taxpayer. Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration.

Instead sales tax will be added to each monthly lease payment. Furthermore sales tax will be added to each monthly lease payment. The title must include an individual named on the lease.

In Virginia you will be taxed upfront on the cost cap of the rented car 6 sales tax rate. Most leasing companies though pass on the taxes to lessees. Some build the taxes.

If personal wealth tax is in effect you must file a tax return and declare all non-exempt property and its value. So if you live in a state with a. If you are unsure of whether or not you are required to pay property taxes on your leased car you can always contact your leasing company or the DMV in your state.

Tax is calculated on the leasing companys purchase price. When you lease a car most states do not require you to pay sales tax on the cost or value of the vehicle. This means that if youre leasing a 20000 car youll have to pay an extra 1650 in taxes over the life of the lease.

The lease must be to a person or persons and it shall not include any commercial entity as a lessee. You pay personal property taxes on the vehicle unless otherwise stated in your lease. Connecticut car owners including leasing companies are liable for local property taxes.

If you pay sales tax on your car lease you may be able to take a deduction for it on your federal income taxes.

Can You Trade In A Car That S Still On A Lease Here S How Shift

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Why You Should Almost Never Lease A Car Moneyunder30

End Your Car Lease Early Sell Swap Or Buy Nerdwallet

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Is It Better To Buy Or Lease A Car Taxact Blog

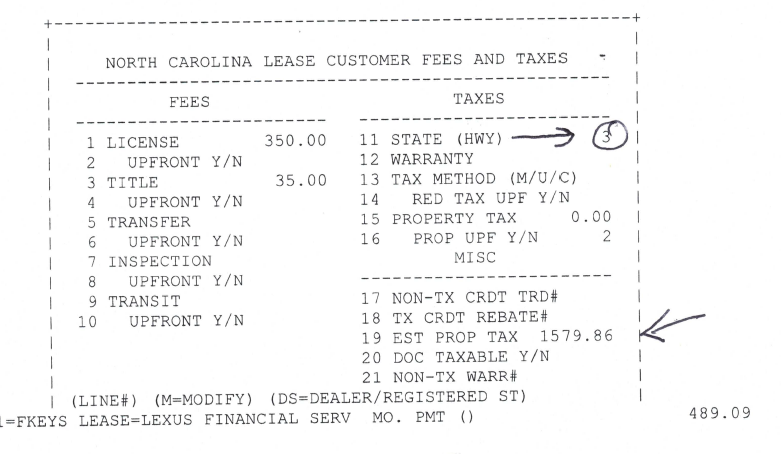

Property Tax When Leasing In Nc Ask The Hackrs Forum Leasehackr

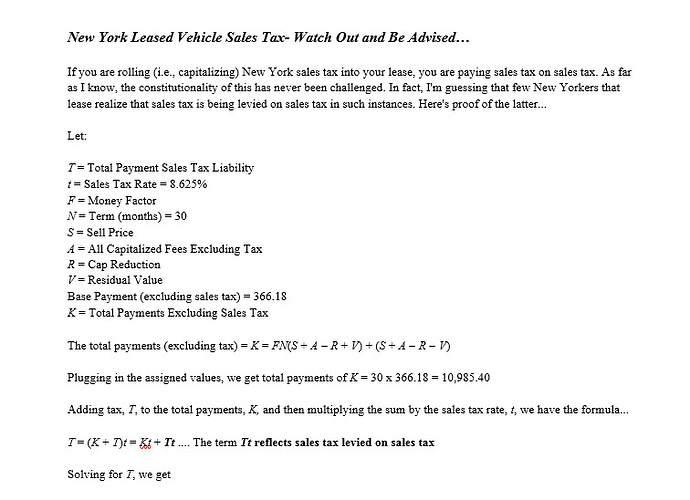

Sales Tax In Ny Off Ramp Forum Leasehackr

What Is The Washington State Vehicle Sales Tax

What Happens When You Lease A Car Credit Com

Virginia Sales Tax On Cars Everything You Need To Know

Car Leasing And Taxes Points To Ponder Credit Karma

Is Insurance On A Leased Car More Expensive Experian

Which Is Better For Taxes Leasing Or Buying A Car Bankrate

Understanding Lease Buyout Auto Loans

Motor Vehicle Taxability Leasing Department Of Taxation

When Should You Lease Your Car Here S The Best Time To Do It Shift