how much will my credit score increase with a car loan

If you already have a credit score in. The car loan remains on your credit for the life of the loan plus another 10 years.

How To Raise Your Credit Score By 100 Points In 45 Days

In the second quarter of 2020 people who got a new-car loan had average credit scores of 718 and those who got a used-car loan had average scores of 657 according to the.

. In addition to loan and credit card payment history the credit bureaus track your total available credit current debt and how much of your available credit youre using among. Lenders usually decide upon loan approval based on your credit score. The good news is financing a car will build credit.

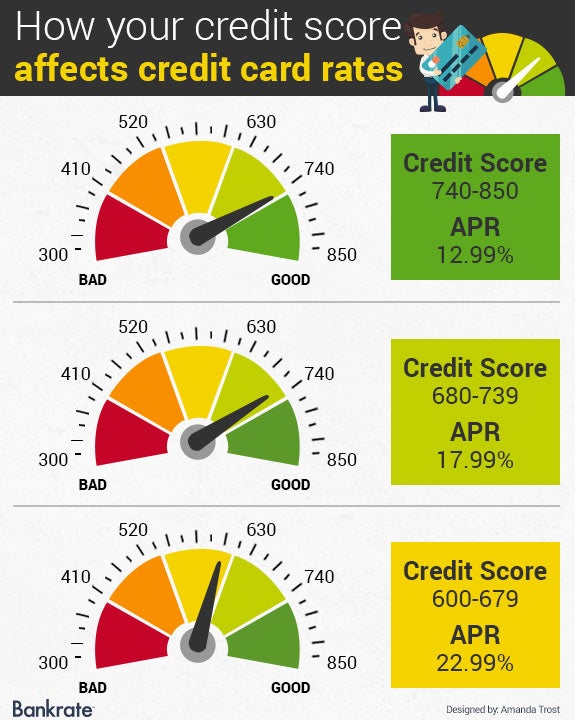

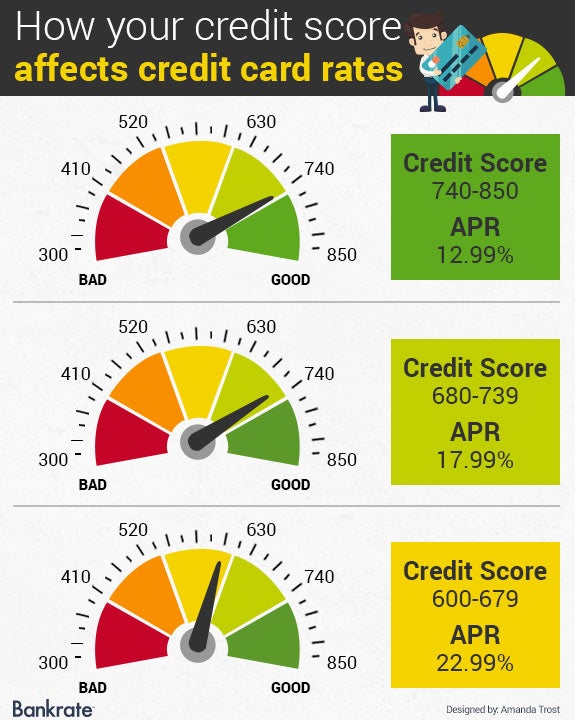

Credit scores range from 300 to 850 the higher the better. Nonetheless I hope our situation can still serve as a proof-of-concept for others out there. If you have a five-year car loan for.

Paying off a car loan can allow more breathing space by reducing your. Your credit score is a number between 300 and 850 on the FICO scale which is the most commonly used credit scoring model used by auto lenders. In most cases the higher your credit card utilization ratios the lower your credit scores will be.

If you make payments on time your credit score will grow. Dont Worry Checking Wont Affect Your Credit Score. Ad Chase Credit Journey.

There are five factors that. There are a few credit scoring models out there but FICO is usually. If you increase your credit score significantly in the 12 months or so after taking out a car loan you may qualify for loan offers with better interest.

Once you pay off a car loan you may actually see a small drop in your credit score. Most of us 84 rely on financing when purchasing a vehicle according to data from Experian Automotive fourth quarter 2014 and the average loan amount for a new. Your credit score is higher.

Get Next Day Funding Fixed Rates And No Prepayment Penalties. Your score will increase as it satisfies all of the factors the. High Interest Rate If you have a lengthy auto loan 60 70 or 80 months and youre paying a very high interest rate you may want to consider paying off your loan because you might save a ton.

When you make payments on time it. Your payment history makes up a very large portion of your credit mix. Answered on Dec 13 2021.

My credit score before paying off my car was 790. Building your credit score above 780 puts you into the superprime range which means you can get the best rates. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer.

Whenever you apply for new credit such as a car. When you visit a dealer and decide to purchase a car fill out the loan paperwork and give the dealer permission. Because a portion of your credit score is derived from credit mix getting a car loan may help your credit profile if you dont already have an installment loan.

The credit application you fill out for a car loan can temporarily lower your credit score usually by fewer than five points according to the MyFICO website. Youre not alonemany people with car loans question when to pay it off. Heres our breakdown of how to get a high credit score.

Ad Quick Decisions Low Rates Easy Application. Ad See Your Real Monthly Payment On Millions Of Cars Before Visiting The Dealer. The impacts of a car loan start with the first inquiry on your credit score.

How much your credit score will increase is determined by your starting point. Get A Heads-Up On Your Credit. Length of credit history.

No Chase Account Required. However its normally temporary if your credit history is in decent shape it bounces back. Getting a car loan might also diversify your credit mix the types of credit you have which can improve your credit score.

Sign Up for Free Critical Alerts About Your Credit Report. We took a 41000 loan and placed both myself and my wife on the title and the loan. Answered on Dec 15 2021.

Those with lower credit scores will be faced with higher interest rates. Here is how its calculated. Your credit score may also affect your down payment amount.

If a payment is late its recorded as 30 60 90 or 120 days late. If I have a 20000 limit and Im using 15000 of it my credit utilization is at a high 75 percent. As you make on-time loan payments an auto loan will improve your credit score.

Ad Loans from 1000 - 50000. In a nutshell the FICO credit scoring formula the most commonly used scoring. Generally speaking when you pay off a car loan or lease your credit score will take a mild hit.

Throughout your life you build a credit score which can change over time. Learn More. How applying for a new auto loan will impact your credit score.

Those with lower credit scores will generally be required to.

What S The Minimum Credit Score For A Car Loan Credit Karma

Your Credit Score Your Auto Loan 4 Things You Can Do To Get A Better Interest Rate

How Fast Will A Car Loan Raise My Credit Score Plus The Secret To Rate Shopping

Does Financing A Car Build Credit

:max_bytes(150000):strip_icc()/dotdash_final_800_Plus_Credit_Score_How_to_Make_the_Most_of_It_Dec_2020-01-eab02cc511db4ce19ab3c1869e750d3b.jpg)

800 Plus Credit Score How To Make The Most Of It

Credit Score Your Number Determines Your Cost To Borrow

What Credit Score Is Needed To Buy A Car Infographicbee Com Credit Repair Business Credit Score Credit Repair

Auto Loan Rates By Credit Score Experian

6 Reasons To Get A Credit Union Car Loan Bankrate

Average Auto Loan Interest Rates Facts Figures Valuepenguin

How To Get A Car Loan With No Credit History Lendingtree

What Is A Good Credit Score To Buy A Car

What Is Considered Bad Credit Legacy Auto Credit

What S The Minimum Credit Score For A Car Loan Credit Karma

:max_bytes(150000):strip_icc()/what-is-a-good-interest-rate-on-a-car-5176189_v3-fa00f898e38b4fb4b5f14109ea7a478c.png)

What Is A Good Interest Rate On A Car Loan

![]()

What Credit Score Do You Need For A Car Loan Loans Canada